In today’s rapidly evolving digital finance landscape, P2P payment apps have gained immense popularity as convenient and efficient tools for money transfers. Among the notable players in this domain are Zelle and Venmo, which have revolutionized how people exchange funds seamlessly.

This article delves into the heart of the matter: understanding the cost factors in developing P2P payment apps akin to Zelle and Venmo. Building such cutting-edge applications involves a myriad of considerations, ranging from:

- The technology stack,

- The user experience, and,

- The stringent security measures.

All this and much more ensure users’ financial information remains safeguarded.

If you’re curious to explore the ins and outs of P2P payment app development, join us on this enlightening journey. We will unravel the essential aspects that influence the cost and success of these transformative digital solutions.

Let’s get this show on the road.

Subtopic 1: Understanding P2P Payment Apps

Definition of P2P Payment Apps:

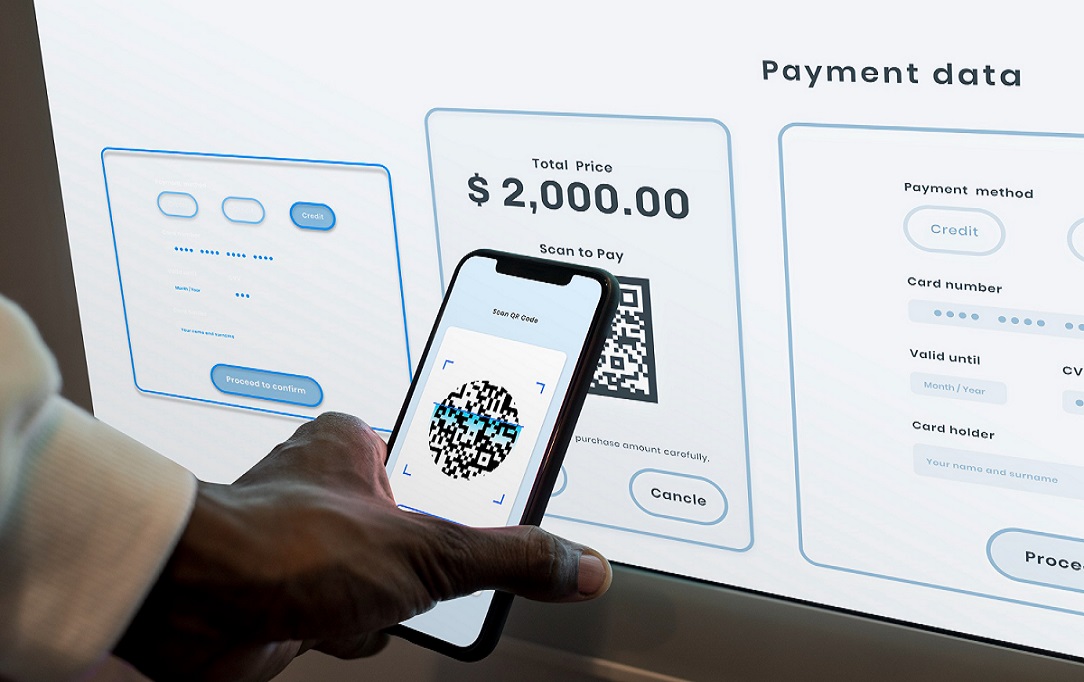

P2P payment apps are digital platforms that facilitate direct transactions between individuals, eliminating the need for cash or checks. That means you can transfer your money

- Fast &

- Safely

Just by using your smartphone.

Role in Peer-to-Peer Transactions:

These apps act as intermediaries, connecting users’ bank accounts or cards to facilitate seamless fund transfers. Users can send or receive money from friends, family, or acquaintances with just a few taps on their devices.

Advantages of P2P Payment Apps:

The popularity of P2P payment apps stems from their numerous benefits. They offer convenience, allowing users to split bills, repay debts, or make small purchases without needing physical cash. Moreover, they enable immediate transfers, eliminating delays associated with traditional banking methods. The apps also offer enhanced security features, encrypting sensitive data to ensure safe transactions.

Subtopic 2: Key Features and Functionality

- Essential Features: P2P payment apps like Zelle and Venmo come equipped with a range of vital features. These include user-friendly interfaces, account registration, and profile setup.

- Linking Bank Accounts: To facilitate transactions, users can link their bank accounts securely to the app. This feature enables direct transfers from the user’s account to another user’s account.

- Transaction History: P2P payment apps maintain a detailed transaction history, allowing users to review past payments, track expenses, and manage finances efficiently.

- Instant Transfers: One of the standout functionalities is the ability to conduct real-time transfers. This feature ensures that money moves swiftly between users, promoting seamless financial interactions.

Subtopic 3: Technology Stack and Platform Selection

- Technology Stack: The development of P2P payment apps relies on a well-structured technology stack. Components like server infrastructure, databases, and APIs are fundamental to their functioning.

- Platform Selection: To reach a broader audience, app developers often target both iOS and Android platforms. This approach ensures accessibility to users on different devices and operating systems.

- Security Considerations: Robust security measures are vital when dealing with financial transactions. Developers must implement encryption protocols and user authentication to safeguard sensitive data.

- Scalability: As P2P payment apps gain popularity, scalability becomes crucial to handle increasing user demands.

Subtopic 4: User Experience and Design

- User-Friendly Interface: A seamless user experience is critical for the success of P2P payment apps. Intuitive navigation, clear call-to-action buttons, and a straightforward layout enhance user satisfaction.

- Impact on User Engagement: Well-designed P2P payment apps drive higher user engagement and retention rates. A user-centric approach, focusing on simplicity and efficiency, encourages users to make frequent transactions.

Subtopic 5: Security and Compliance

Paramount Importance of Security: Security is a top priority in P2P payment apps, as users entrust their financial data for transactions. Implementing encryption, multi-factor authentication, and fraud prevention measures safeguards user information.

Data Protection and Regulatory Adherence: Compliance with financial regulations, such as PCI DSS and GDPR, ensures data protection and builds trust with users. Adhering to industry standards is crucial to maintain the app’s credibility.

Subtopic 6: Development Team and Cost Factors

- Ideal Development Team: Building a proficient development team is crucial for P2P payment app development. A team typically includes app developers, UX/UI designers, backend developers, and QA testers.

- Cost Factors: The development cost of P2P payment apps varies based on multiple factors. Development hours, complexity, features, and technology stack significantly impact the overall cost. Prioritizing essential features and functionalities can help manage expenses.

By prioritizing user experience, adhering to security measures, and forming a competent development team, businesses can create P2P payment apps that resonate with users and provide secure and convenient financial transactions. Additionally, understanding cost factors aid in budget planning and resource allocation, ultimately leading to successful app development.

Subtopic 7: Testing and Quality Assurance

- Ensuring App Functionality and Security: Rigorous testing is crucial to identify and rectify any potential bugs or glitches in P2P payment apps. Thorough testing helps ensure that all features, such as fund transfers, notifications, and account linking, function flawlessly.

- Seamless User Experience: Quality assurance plays a pivotal role in delivering a seamless user experience. By conducting comprehensive testing, developers can verify that the app performs optimally across various devices and platforms, ensuring a consistent experience for users.

- Security and Vulnerability Testing: P2P payment apps deal with sensitive financial information, making security testing vital. Identifying and addressing security vulnerabilities helps safeguard user data and prevent potential breaches, fostering trust among users.

- User Acceptance Testing: User acceptance testing involves real users evaluating the app to provide feedback. This helps identify any usability issues and obtain valuable insights to improve the app further.

- Beta Testing: Conducting beta testing with a selected group of users allows developers to gather feedback and make necessary improvements before the app’s full release. Beta testing helps ensure that the final product meets user expectations and requirements.

By prioritizing thorough testing and quality assurance throughout the development process, P2P payment apps can be launched with confidence, offering a reliable, secure, and user-friendly platform for seamless financial transactions.

Conclusion:

In conclusion, P2P payment app development is a dynamic and thriving sector in the digital finance landscape. We explored the key aspects of creating successful payment apps like Zelle and Venmo, understanding their significance in facilitating secure and convenient money transfers. Throughout the article, we highlighted the key features, functionalities, and technology stack involved, emphasizing user experience and security. Thorough testing and quality assurance were identified as pivotal factors in delivering a seamless and reliable app.

The process of developing P2P payment apps involves careful planning and consideration of various cost factors. By collaborating with reputable app development company and skilled app developers, businesses can ensure a smooth and efficient development journey.

With the demand for secure and efficient payment apps on the rise, now is the perfect time for businesses to embark on payment app development ventures and establish a strong presence in this competitive industry. By staying ahead in the realm of payment app development, businesses can unlock a world of potential and gain a competitive edge in the digital finance arena.